The most important emerging concept in business, technology, and design for real estate and city actors is: the platform.

This analysis helps to prime understanding of the issues - and is an introduction to the forthcoming Last Meter® book by BASE2, The Platform Age, available to BASE2 partners.

Calling things platforms is easy. But it's only going to happen more: platforms are all around. So: it's time to get a sense of why this is and what to do. Let's define it stepwise.

From the 1990s onwards, without a focus on the internet, the concept of platforms joined business language. Even before that, the metaphor of platform, as a type of human activity, was current.

The word itself is fine: a platform was, and is, a thing that supports other stuff.

And the first definition of a platform as a metaphor and business idea is very close to that:

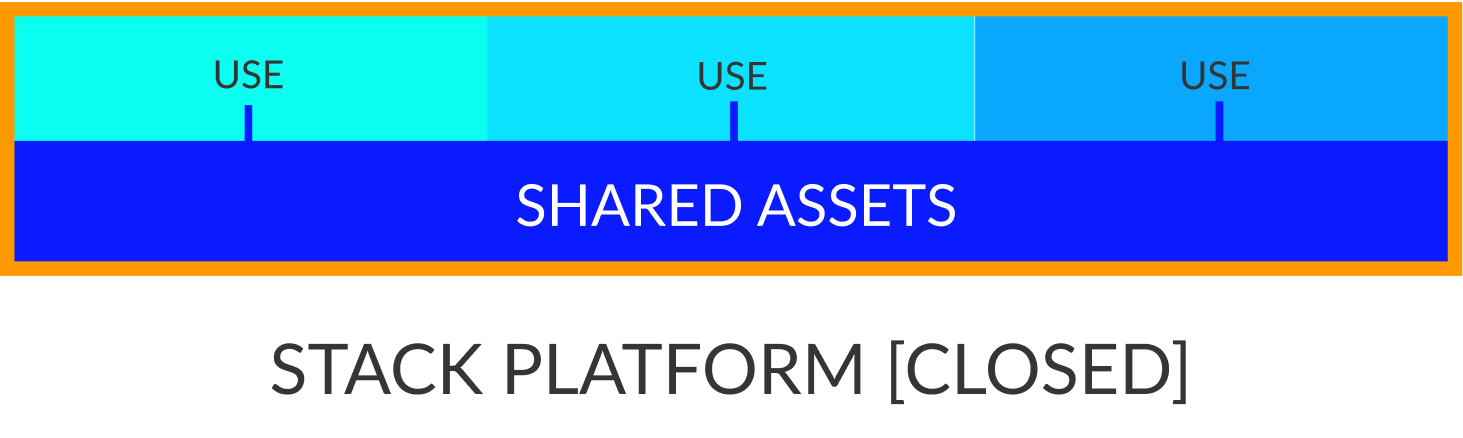

Stack platform: This is the classic platform concept that spans pre-modern, pre-internet, and many current business concepts that use or are described by the phrase platform.

In stack platforms, an offer is available where some assets are supporting others in a way convenient to producer and consumer: hey presto! - platform.

Microsoft Office was and is a 'platform' in this sense: there are core, shared modules in the suite that support each particular application. Indeed the whole of the Wintel, Windows + Intel, package was a platform.

Beyond that, the definer of stack platforms–and why they are increasingly out of date–is that the 'shared' assets are only available to the asset owner. The owner can use the supporting elements efficiently--but only them.

Microsoft can build features on the shared technical modules of its Office Suite, and you can access those features. But you can't add to or offer features attached to Office, using those modules–even if that would benefit Microsoft. Stack platforms are closed by definition. And that's the opportunity for the platforms of today.

In this broad sense that a stack platform has internal elements that support others, any business has platform potential.

For example: say you start a shoe shop. Not exactly a platform? But if you start offering coffees to customers trying on shoes - boom, the shop is a platform. As such, brands are potential platforms. Places are platforms. Platforms are all around–in this established and boring sense.

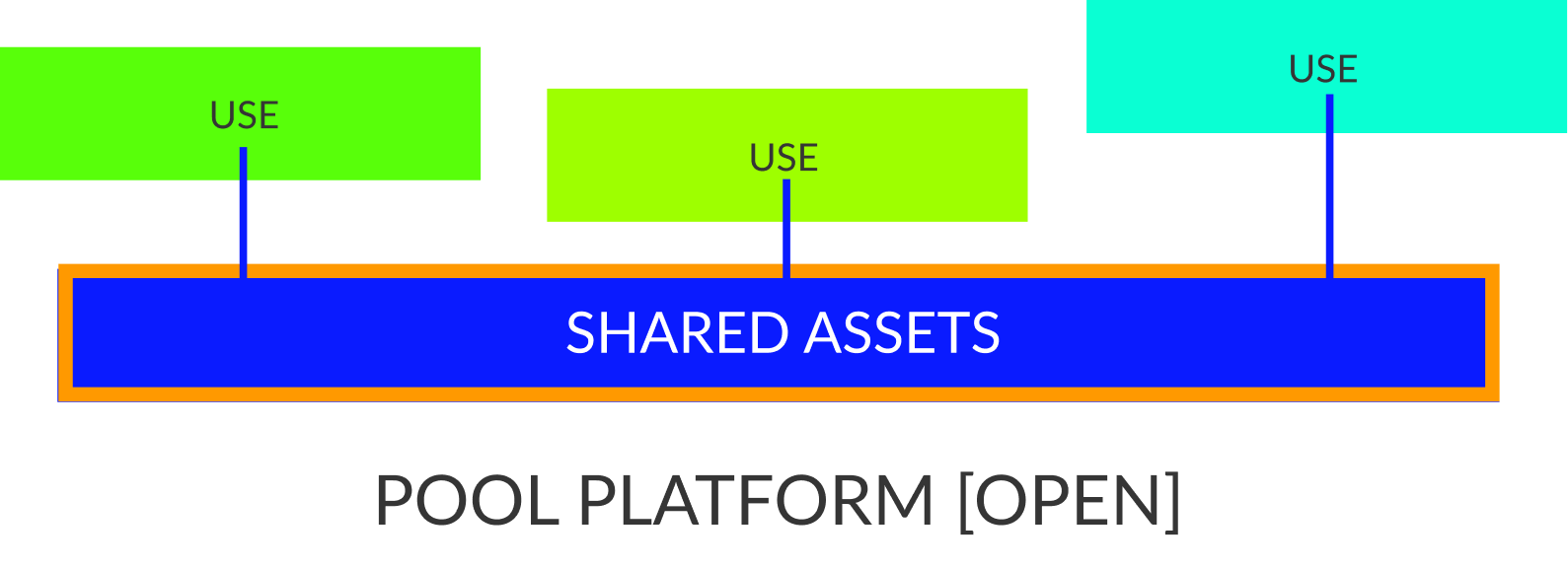

What's next in platforms is addressing the limits of stack platforms: access to the supporting elements, ie internally-shared assets, by non-owners. The first of these is the

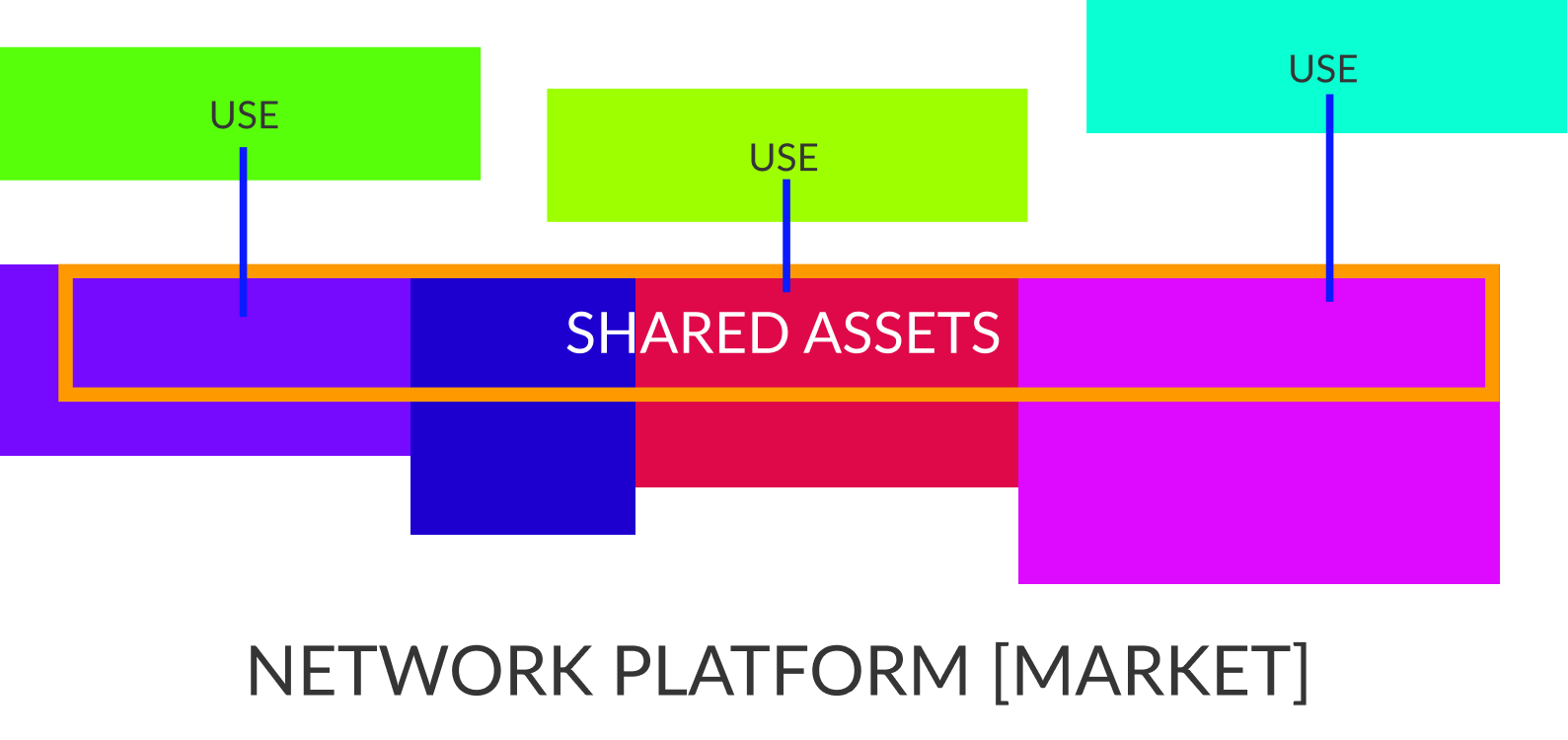

Pool platform: Modern platforms are almost all pool platforms. Similarly to stack platforms, pool platforms start with something that supports other things, some kind of shared assets.

These can be physical resources, digital resources, data, people, any kind of stuff. But what distinguishes pool platforms from stack platforms, firstly, is that the while stack platforms are closed, pool platforms are open–at least in the limited sense that people other than the resource owners, with the permission of the owners.

Pool platforms reveal the long history of the concept. Because: many of the oldest institutions in history can be, correctly, seen as pool platforms. Non-owners are accessing and supported by resources owned by someone else. Granaries, harbours, markets in ancient Greece; stables and farmland pre-modern history; coffee-shops today–all these can be seen as pool platforms.

In fact, clearly, there is a lot of overlap between pool platforms and concepts of sharing, services, and trading. Sadly, economics has not advanced far or fast enough to create reliable theory about this.

Some business thinkers are adding theory suggestions as fast as they can: start with Machine, Platform, Crowd by Andrew McAfee and Erik Brynjolfsson. Although their guidance is more for orientation than calculation, it's necessary to engage with it.

Importantly: pool platforms naturally evolve into markets. This is because, if you have gathered a set of resources with different actors able to access them, one of the models that arises is the efficient trading in cluster that defines markets.

But before moving to markets and the next level of platforms, let's note the second defining feature of pool platforms, other than the openness of the pooled resources: it's the sophistication of the connections that start to arise around the users of pool platforms. It's this connective richness that makes pool platforms so useful.

Networked platform: Technically, what makes a market a pool platform is not the products for sale, which are not pooled per se, but the price information, which is pooled, by necessity.

It's notable that pool platforms don't need the internet to come into existence, they just need some context for collecting and distributing resources. For grain, go to the granary. For the best prices, go to the market, literally.

What has happened to platforms in the internet age is not just the small miracle of pool platforms becoming visible and even accessible any where in the world, in real time, but the huge miracle of multiple pools of resources being accessible in one platform. This miracle we can call: networked platforms.

This distinction between online pool platforms and truly networked platforms is the most important thing for real estate and city actors to understand.

So if you don't get it, think it through again, or ask for help: because the future of your entire industry hinges on this, maybe more than anything else.

An online pool platform is one where the owner of the assets has made the assets available to others. Amazon Web Services are the classic online pool platforms: store data, accessing computing power, remotely and on-demand, from the pooled capacity of Amazon's servers.

But a networked platform is one where the 'pool' of resources is primarily not owned by the platform owner, or any one actor. Enter: AirBnB and Uber.

These are platforms that couldn't have existed before the digital age. Because the pool of resources is not just consumed via the net, it's 'produced' by the net. AirBnB enables access to a pool of properties that are only pooled digitally. There is no association of homeowners, or hotel-like entity, that controls all these rooms directly.

So, while the networked platforms carry forward all the power of resource pooling, and complex access and trading configurations of pool platforms, what they add add is the power of aggregation of distributed resources in the first place.

It's this unique aggregating power of networked platforms that is making them so terrifyingly powerful, unstoppable even. Because all that a networked platform needs to do, in principle is recognise an available resource, and then they can add it to a pool, in which context it can be come vastly valuable by the nature of networks. Facebook is a networked platform—for advertisers.

One user buying a Coke is possibly a result of an ad they saw. A million users buying a Coke after seeing an ad in their feed is definitely a result of an ad they saw: but how would you know if you weren't aggregating a pool of datapoints and making that available to Coca Cola corporation?

What do cities and real estate need to know here? There's a lot to consider, and we'll analyse it over time step by step.

But the biggest one is to get real about platformization of urban and real estate assets - who is doing it to whom, how to get it done.

Platform are all around us not just because everyone is using the term loosely. The reason is that the digital era has made it possible for any asset anywhere to be aggregated to a pool.

Sure, software is eating the world, but networked platforms are devouring it.

How does this work? We have described this already in terms of Facebook: your innocent, uninteresting individual behaviour is quietly aggregated—and soon enough Facebook is worth hundreds of billions of dollars.

But it's also happening all around in ways that are not yet very obvious, mainly when assets that the owner manages only in quite a vague way, or whose owner is not even clear, start being aggregated into someone else's network, sometimes in subtle ways.

Lots of travel and tourism apps go hunting for the undiscovered locations in cities and far-off destinations, and use travellers to aggregate the information. But what if residents don't want to added to a networked platform like that? Pretty locations in cities across the world are already complaining that Instgram has made them into visual commodities, and the visitors are highly disruptive.

Waze aggregates driving directions from users, likewise, and has itself ended up creating 'shortcuts' to 'beat the traffic' - that just send droves of traffic through private streets, leading to reduce safety, calm and privacy.

These are examples of passive platformization: where assets are being pooled into networked platforms, but the owners of the assets are not being asked or rewarded.

Guess what? Passive platformization is happening at vast scale in the urban and real estate space.

Every time a package is left in a corridor, or even in a lobby, or a scooter is left on the sidewalk, or a delivery robot trundles along the street, the space and environment that belongs to a real estate owner or city authority is being passively platformized into the networked pool of resources that the delivery company and retail, or the scooter company, or robot company, are using to run their businesses.

If they couldn't deliver packages to corridors and lobbies, or allow users to dump scooters anywhere, how fast would their businesses grow?

Bringing this passive platformization to visibility is a matter of scale–if there's one package this month in the corridor - that's life. If there's ten every day–that's a fire risk, an uncosted liability and unrewarded asset exploitation.

Cities are getting wise to this: they are actively preventing the passive platformization of urban infrastructure by marking some spots as inaccessible to scooter riding and parking. Real estate: not so much.

Real estate has basically two possible responses to passive platformization—other than do nothing, which is increasingly unrealistic given the extraction of value and transfer of risk.

1 Self-platformize: This is the response of some large real estate companies, who believe they have understood the platform age sufficiently. Self-platformization has two types and we know them already: stack platforms and pool platforms.

Stack platformization in real estate basically involves owners or managers offerings its users a set of things that it itself supplies: you want swimming pools, laundry, meals? We got you! It's the hotelization of real estate: procuring, managing, adding features that are controlled, offered and directly monetized by the property owners and managers.

Pool platformization this where the owners or managers partner with third-party services, granting access to assets which include the users and the property itself, as a 'pool' of resources.

Is stack and pool self-platformization going to work for real estate? Short answer: no.

The reason is that in both cases, more or less, it is either too expensive or there is not enough money being made, or both.

In almost all cases, where the real estate owner has control of only a few properties, or just one, it makes no sense for the owner to add a stack of features onto its core assets. It would be prohibitively expensive, in most cases, for a single multi-family residence to have its own private laundry, for example.

Even where owners are not trying add their own features, but partnering with third parties, the cost of business is huge, and the value of business is small.

Why? Because the aggregation effect has gone. Pool platforms work because there is an overwhelming opportunity for an actor to offer a resource they control to a lot of actors. Millions of users want to use Amazon's servers. Only a few non-residents will ever want to use an apartment building's private swimming pool. Even Amazon doesn't want to access your 50 tenants that much. If you try to negotiate a price for building access with them—they will ignore you.

Very large real estate actors, particularly those already in an aggregating role such as property managers, can possibly stabilize either stack platforms or pool platforms on their own, particularly if they already have an advanced relationship with their users. But it will be very very expensive, and probably only work for luxury experiences.

And the power of networked platform is likely to be overwhelming anyway. This is partly because it's just so much more attractive and convenient—for everyone—to have larger sets of resources aggregated. But it also because networked platforms by definition serve and engage many more asset owners, who otherwise cannot realistically engage on their own: the incentives are far greater.

Consider AirBnB's Experiences offering: it is aggregating a pool of networked resources of people's local skills and adding them to the AirBnb property experiences.

How could local property owners do that? Without some platform looking a lot like AirBnB, their own self-platformization efforts would offer the Experiences sellers a tiny market, but still require a lot of administration. Networked platforms are self-forming monsters: they are maybe the most powerful phenomena unfolding at the boundary of the digital and physical worlds.

If allowing passive platformization to continue is not an option, and self-platformization is not realistic for small actors and risky for large actors, what's the second, and remaining, option?

2 Platform Integration: What's left for real estate and city actors is attaching themselves to mostly network platofrms by means of platform integrators.

Platform integrators are actors who work with urban and real estate owners to interface the relationship between their assets and the platforms that want and need to access them.

This is not as complex as it sounds - and it is a common practice already in real estate. An asset associated with much urban space and property is parking, and often enough the parking is underused by the people living or working in the space.

The way that the asset owner makes the parking asset available more flexibly and efficiently is through a parking integrator: an actor who supports enables the use of the asset in a pool platform or networked platform context.

A platform integrator is naturally in a brokerage role - aggregating and balancing demand for resources with supply, and supporting and structure the exchange. But the additional aspect that makes them an integrator is the technical and organizational relationship with the space.

And this is the path BASE2 believes is natural and efficient for the real estate sector. Real estate's physical and data assets are being passively platformized in a myriad ways—deliveries+experiences, internet connectivity, sensors and data networks, access control, energy, and more to come.

Last Meter® is a service integration platform–a business-to-business tool to enable real estate to govern, step by step, the opportunity of user services that platformize their 'last meter', the space between the last mile and the private apartment or office. Space Engine™ is a service integration architectural and urban design tool that supports deeper service integration for new-build developments.

To do nothing is to create a habit—for users and third party companies—of non-engagement and acceptance of passive platformization of private assets, that not only doesn't add value now but may be hard to fix later. And to jump into self-platformization is a risky and often doomed enterprise that will creates costs without much guaranteed value.

If there's anything beyond networked platforms it's what happens when platforms start overlapping and assets are available via multiple networked platforms: we could call this an ecosystem platform.

Ideally, in an ecosystem platform environment, power and influence is divided in a more stable way among actors, in part because the aggregations achieved in the networked platform economy are…themselves being aggregated.

For now, it's enough that real estate owners can understand and distinguish among

- stack platforms

- pool platforms

- networked platforms

and understand that at a time of massive passive platformization, including asset exploitation and risk transfer, by the large networked platforms companies, they can decide, if they don't choose to do nothing, between

- self-platformization of their assets

- platform integration via platform integrators to take back control of their assets from networked platforms.